Bond insurers who walked away from mediation last year before Stockton filed for bankruptcy are at the table this summer. A deal could avoid a precedent-setting legal showdown on whether public pensions can be cut in bankruptcy.

Attorneys for the city and bond insurers told U.S. Bankruptcy Judge Christopher Klein last week that mediation, presided over by Judge Elizabeth Perris, is an “uphill battle.”

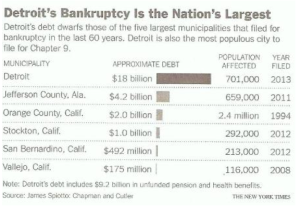

But the brief update hearing was held on the day that Stockton, which had been the largest city to file for bankruptcy, was bigfooted by the bankruptcy filing of a much larger city known around the world, Detroit.

Now will the big national bond insurers, who lost the first round when Stockton was ruled eligible for bankruptcy in April, decide the main battle has shifted to Detroit and cut a deal with Stockton, where they have less exposure and a weaker hand?

In Detroit, city officials propose cutting the pensions of current workers and retirees. A state judge quickly ruled after the bankruptcy filing that pensions are protected by the state constitution, triggering an appeal that may yield a precedent-setting ruling.

In Stockton, city officials do not want to cut pensions, saying they are needed to recruit and retain workers, particularly police. Bond insurers facing major losses under the city’s plan argue that pensions should be treated like ordinary debt.

Bond insurer losses in the bankruptcy presumably would be reduced if the city spreads the pain, getting more of the savings needed for solvency by cutting pension debt owed to the California Public Employees Retirement System.

Judge Klein told the bond insurers the pension issue may be raised in a ruling on whether creditors are treated fairly by the city’s proposal for a “plan of adjustment” to cut debt, expected in September.

“The city is drafting both a cram-down plan and a consensus plan — hope to use the consensus plan, not the cram-down plan,” Marc Levinson, an attorney for Stockton, told the judge last week.

A “cram down” is legal jargon for a plan that cuts payments to creditors without their consent. Stockton announced a deal in February with one bond insurer, Ambac, to trim $21.6 million in debt payments for a housing project.

Two bond insurers backing larger Stockton debt payments, Assured Guaranty and National Public Finance Guarantee, are the leaders of a bondholder group, Capital Market Creditors, that unsuccessfully opposed Stockton’s eligibility for bankruptcy.

The two bond insurers have major financial exposure in Detroit, according to their websites, more than the losses they face in the bankruptcy Stockton filed in June of last year.

Assured Guaranty insured $1.8 billion worth of Detroit revenue bonds and $321 million in general obligation bonds. National Public Finance insured $2.4 billion worth of Detroit revenue bonds and $101 million in general obligation bonds.

Stockton, on the other hand, is proposing to eliminate $197.5 million in general fund payments on bonds during the next 25 years, leaving insurers to make payments preventing losses for bondholders.

Graph from New York Times, July 19, 2013

The two bond insurers, using expert witnesses and numerous document requests, made a lengthy effort to block Stockton’s eligibility for bankruptcy, which some thought was their best chance of avoiding deep cuts in bond payments.

National Public Finance cited court rulings saying eligibility should be regarded with a “jaded eye,” because the court has only limited control of the debtor once eligibility is approved.

The city proposes the debt-cutting plan of adjustment, not the creditors. The court can approve or reject the plan proposed by the city. But the court cannot impose a plan or tell the city how to spend its money.

Last year the two bond insurers walked out of mediation required by state law before a non-emergency bankruptcy filing. They said the city refused to cut the debt owed its largest creditor, CalPERS, about $323 million.

But during their time-consuming opposition to eligibility, the bond insurers never presented a method for cutting pension debt. Stockton argued that a cut could terminate its CalPERS payment, triggering a $1 billion payment due immediately.

In addition, Stockton contended that CalPERS is only a “conduit” and that the debt is owed to current workers and retirees. The city argues that the elimination of generous retiree health care promised employees is the retiree share of debt reduction.

The Stockton plan is similar to the Vallejo bankruptcy, where bond payments and retiree health care were cut. But during its 3½-year bankruptcy, Vallejo negotiated an agreement on its plan of adjustment, avoiding a cram down.

Stockton did avoid having dueling tax measures on the November ballot. The city council voted unanimously this month to place a ¾-cent sales tax increase on the ballot, yielding an estimated $28 million a year if a majority of voters approve.

Most of the money, 65 percent, is intended for more police and other steps to reduce crime. The rest could be used to help the city exit from bankruptcy and regain solvency. Whether the city might sweeten its offer to bond insurers is not clear.

Mayor Anthony Silva, who ousted an incumbent in the election last fall, had backed a “Safe Streets” sales-tax initiative limited to hiring more police. Opponents, including a majority of the city council, said the initiative would prolong bankruptcy.

A developer backing the initiative, Alan Barkett, said during a debate on the two initiatives in May that the city should use bankruptcy to address the high cost of pensions that threaten the long-term solvency of the city.

CalPERS supported Stockton’s eligibility for bankruptcy but is the leading opponent of eligibility for San Bernardino, which filed for bankruptcy last August, automatically staying debt collection.

San Bernardino made an emergency filing, avoiding mediation, and took the unprecedented step of skipping its payments to CalPERS last fiscal year, about $14 million, before resuming this month.

As in Stockton, San Bernardino officials say they do not want to cut pensions, but they do want to refinance pension debt. CalPERS does not want to refinance the missed annual payments, apparently fearing other struggling cities might skip their payments.

Some observers say U.S. Bankruptcy Judge Meredith Jury, who seemed skeptical of another CalPERS request for more city financial information last week, may be moving toward a ruling on San Bernardino’s eligibility next month.

In Vallejo, still struggling with a $5 million budget deficit and high labor costs, a city manager hired after the bankruptcy has some advice for Detroit, an on-line Michigan magazine, Bridge, reported last week.

Dan Keen told the magazine his postcard to Detroit would be short, if not sweet: “My advice for city considering this jump is get everything you can during bankruptcy, because when you come back out of bankruptcy, it’s going to be even harder.”

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at http://calpensions.com/

Crossposted on Calpensions