California has one of the highest costs of living in the United States. California also is one of the most inhospitable places to run a business in the United States. And despite being blessed with abundant energy and an innovative tradition that ought to render the supply of all basic resources abundant and cheap, California has artificially created shortages of energy, land and water, and a crumbling, inadequate transportation and public utility infrastructure.

The reason for these policy failures is because the people who run California are the public sector unions who control the machinery of government, the career aspirations of government bureaucrats, the electoral fate of politicians, and the regulatory environment of the business community. To make it work, these unions have exempted government workers, along with compliant corporations and those who are wealthy enough to be indifferent, from the hardships their policies have created for everyone else.

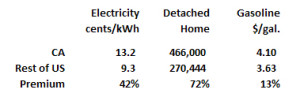

Here’s just a taste of what California’s middle class, too rich to qualify for government handouts and too poor to be indifferent, has to endure compared to the rest of the United States:

CALIFORNIA’S PREMIUM, 2014 – HIGH PRICES FOR THE BASICS

It’s not hard to estimate how these premiums, 13% for gasoline, 42% for electricity, and 72% for homes, translate into the necessity to work and earn tens of thousands of dollars more each year in order to live in California instead of almost anywhere else in America. As for the tax and regulatory environment, respected tax fighter Richard Rider maintains a well-researched list of tax and business statistics entitled “Unaffordable California,” updated here quarterly. The substance of that report is this: Californians pay higher taxes and endure more restrictions on business than anywhere else in America. Read the details. It is as mesmerizing as it is disgraceful.

It’s not hard to estimate how these premiums, 13% for gasoline, 42% for electricity, and 72% for homes, translate into the necessity to work and earn tens of thousands of dollars more each year in order to live in California instead of almost anywhere else in America. As for the tax and regulatory environment, respected tax fighter Richard Rider maintains a well-researched list of tax and business statistics entitled “Unaffordable California,” updated here quarterly. The substance of that report is this: Californians pay higher taxes and endure more restrictions on business than anywhere else in America. Read the details. It is as mesmerizing as it is disgraceful.

There is a simple and effective solution to ending California’s war on the private sector middle class by public sector unions and their corporate cronies. But first it is important to point out another depredation, one that rivals the unaffordable cost-of-living, wreaked onto California’s beleaguered private sector middle class by public sector unions and their financial cronies.

The following graph, courtesy of Charles Hugh Smith (ref. “The Generational Short, part 2“) shows everything you need to know about saving and investing in the 21st century:

INVESTING FOR RETIREMENT IN AMERICA – 2014

VOLATILITY FOR CIVILIANS, GUARANTEED 7.5%/yr FOR PUBLIC SERVANTS

Careful review of the above graph will indicate that the top of the vertical green line to the far right represents today’s market attainment. A market that, in the case of the DJIA, has whipsawed between 6,000 and 16,000 in less than ten years. You don’t have to be a Ph.D economist to recognize we’re contending with rather unsettling volatility these days. If you were to posit that right now we’re seeing another run up of bubble assets – both for equities and real estate – you’d be in good company. And it doesn’t take much more than horse sense to know that going out and earning a “risk-free” 7.5% per year (more significantly, 4.5% after inflation), average, for the next 30 years, is a fool’s errand.

Yet that is precisely what unionized public employees get “guaranteed” by their pension funds, give or take a half-point. And the fools who guarantee this 7.5% are the taxpayers who themselves are forced to risk their own retirement savings in a market that is at a historic high, in an era of unprecedented levels of debt as a percentage of GDP, that displays volatility sufficient – at any moment – to wipe out an individual’s savings at the same time asprofessional traders profit on the swings.

And herein lies the solution. Because the seismic outrage that any financially literate taxpayer may feel at being so dispossessed, so insecure despite making utterly responsible financial decisions, is not shared by the 25% or more of the population who live in a government worker’s household. It is not cruel or spiteful, but rather to salvage our social contract, to require government workers live by the same rules as the citizens they serve.

When the people who operate the machinery of government earn comparable compensation, endure the same risks, face the same hard decisions, and live with the same levels of financial insecurity as the rest of the population, they will adopt entirely new attitudes towards legislation affecting the cost of living, the business climate, the tax burden, and the profound public policy challenges of retirement security. Unlike today, their political incentives will be to make common cause with the people they serve.

Instead, their unions broker deals with politicians they elect. They use environmental laws to fight infrastructure investment in order to pay themselves instead. They pour money into pension funds and bond underwriting firms, making government the biggest partner of Wall Street – their proverbial demon. They block development of land, energy, water and transportation assets in order to assist their corporate cronies who control existing supplies to profit from the resulting scarcity and lack of competition. This contrived scarcity also creates the asset bubbles that inflate the tax base and nominally preserve pension fund solvency.

If public sector unions were outlawed, public sector workers would join with private citizens to forge a new political identity freed from vested interests and privilege. They would support policies designed to break up monopolistic entities, creating competition and lowering the cost of living. Public sector workers would make less, but they would also pay less to live, and the savings could be invested in infrastructure upgrades especially for water and transportation. These investments, along with revitalized land and energy development, would render the basic necessities of living abundant and cheap, instead of scarce and expensive. This California renaissance requires only one thing – the abolition of public sector unions.

Ed Ring is the executive director of the California Policy Center.