“President Trump’s proposed budget would likely result in billions of dollars of cuts to vital health and human services programs in California, state Democratic lawmakers and advocates for the poor said Tuesday,” reported the Los Angeles Times,

“It’s unconscionable and un-American,” blasted Gov. Jerry Brown, who himself slashed state social spending to balance the budget.

In announcing the May Revision to his budget proposal for fiscal year 2017-18, Brown warned, “We have ongoing pressures from Washington and an economic recovery that won’t last forever.”

Actually, to use a line from another California governor, Ronald Reagan: You ain’t seen nothin’ yet. The cuts in California programs soon will be much larger than those in Trump’s proposal, and they will strike whether or not he’s president, or the White House occupant is Elizabeth Warren or the ghost of Lyndon Baines Johnson. Nor will it matter if Nancy Pelosi again becomes House speaker and is joined by Chuck Schumer as Senate majority leader.

The reason is simple: The Baby Boomers will continue retiring, and Social Security and Medicare payments will gobble up an increasing proportion of federal spending. That will crowd out everything else: spending for defense (especially wars), even though Trump now wants to increase defense spending $50 billion a year; and for all discretionary spending, including for health, education and welfare transfers to state governments.

According to Brown’s May Revise budget proposal, general fund spending would be $124 billion for fiscal 2017-18, which begins on July 1.

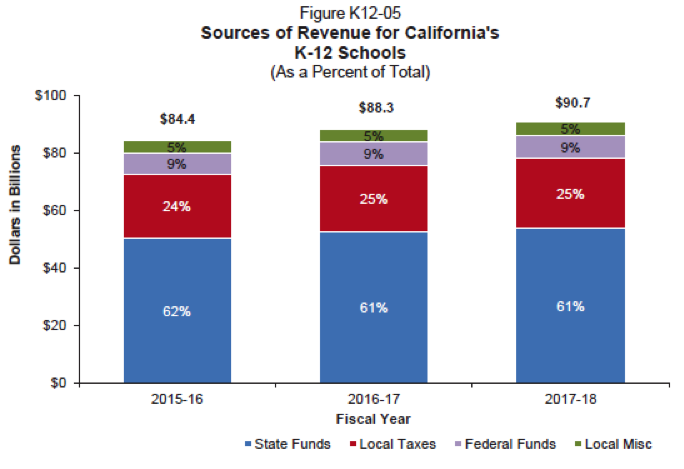

Brown’s January budget proposal included more details on federal funding. For example, turn to p. 28, Figure K-12-05. We see the $90.7 billion in revenue for K-12 education will come 61% from federal sources.

The May Revise also warns: “The state must also continue to plan for and save for tougher budget times ahead. The federal government is contemplating actions – such as defunding health care for five million Californians, eliminating the deductibility of state taxes, and zeroing out funding for organizations like Planned Parenthood – that could send the state budget into turmoil….

I got some of the following charts from an article on the libertarian website LewRockwell.com, by Gary North, Ron Paul’s first economic adviser. Title, “Guns or Granny: The Looming Political Battle of the West.” North, who has written about this issue for years, copied the charts and data from non-libertarian sites. His analysis makes sense to me. But feel free to come up with your own interpretation of the independent data.

His conclusion, “Sometime before the 20’s are over, there will be no more discretionary slice of the budgetary pie. At that point, there is going to be a guerilla war in Washington. It will be a battle over the size of the slices of pie. Political voting blocs that thought the size of their slice was guaranteed will find that it isn’t.”

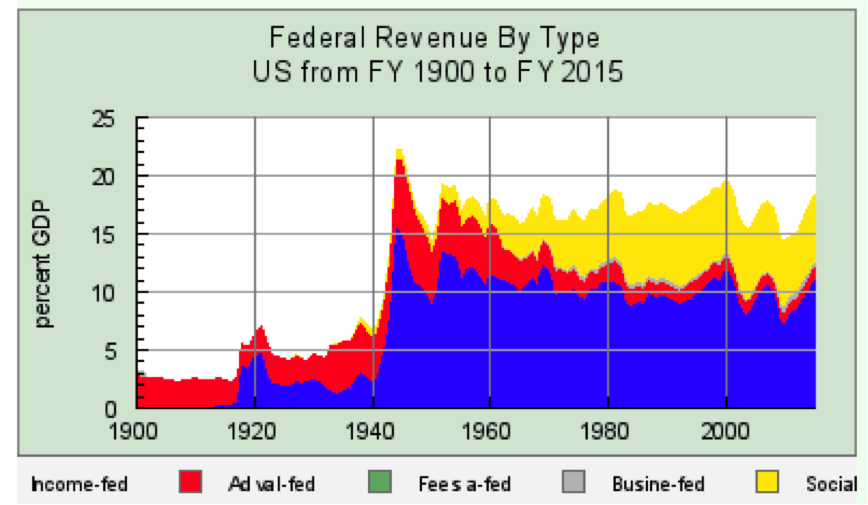

Check out this chart:

The first thing to note is federal taxing is limited to 20% of GDP. In America’s entire history, it only briefly went slightly above that amount during World War II, until Hitler and Tojo were defeated. Then it went back below the 20% threshold. Americans just won’t be taxed more.

In most years since1970, the federal government has spent more than revenues, usually around 23% to 25% of GDP. That is, spending is at least 3 to 5 percentage points above revenues. That’s how presidents and Congress have run up a massive debt that now clocks at $20 trillion. This year’s projected deficit of $603 billion, in the proposed Trump budget, sure doesn’t help. The rising debt, of course, means higher interest payments in the future – meaning less money to spend on other areas.

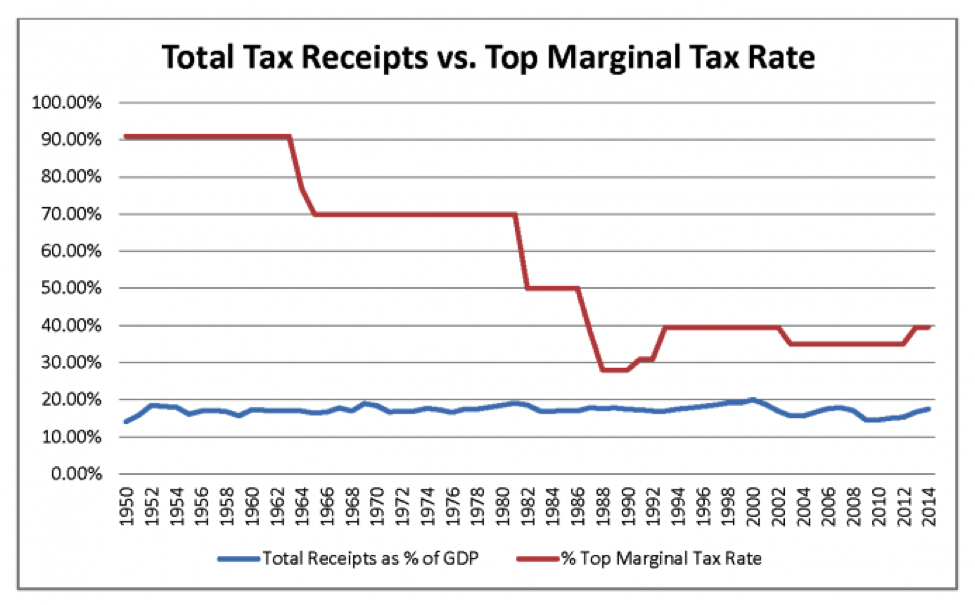

Note that there is no connection between the top marginal income tax rate and tax receipts. Even if President Warren boosted the top tax rate back to 90%, as it was in the 1950s, total tax receipts would not rise, but would remain under 20%.

So, there isn’t going to be any more money. And more Baby Boomers will be retiring, putting extra demands on Social Security and Medicare. That means: Something has to give.

North’s point is that old people are not going to let their Social Security and Medicare be cut before everything else is cut: defense, education, environmental programs, science, etc.

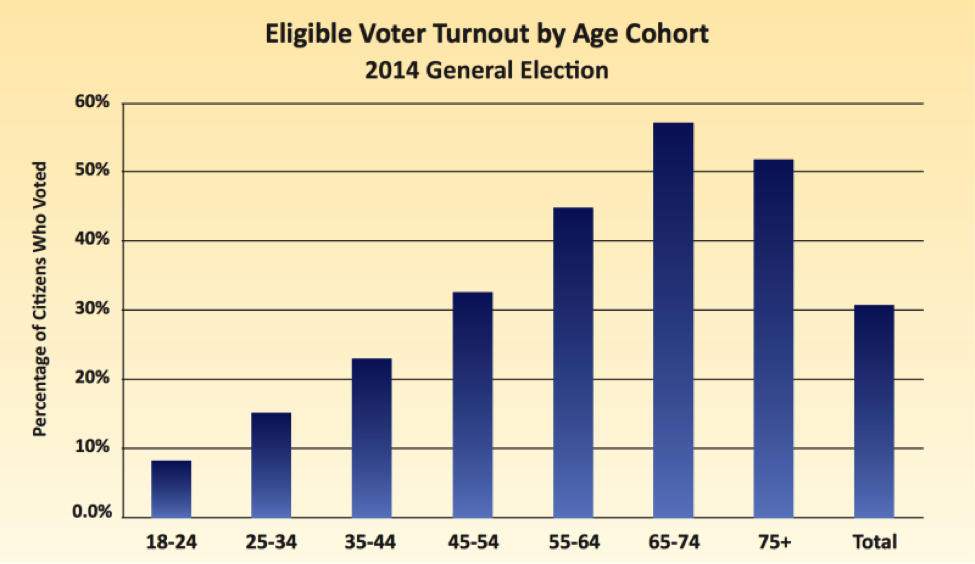

Here’s a chart I found from the UC Davis Center for Regional Change from the 2014 California election:

Notice how those ages 64-74 voted more than six times those of ages 18-24. That was not a presidential election year, but the votes affected congressional races. And it’s the Congress that passes the bills, not the president. In a democratic system, with majority ruling, if it’s Social Security and Medicare vs. aid to colleges and K-12 schools, who’s going to win that battle? Who is more likely to write a letter to Rep. Porkbarrel insisting on funding? It won’t matter whether the honorable representative is a Democrat or a Republican.

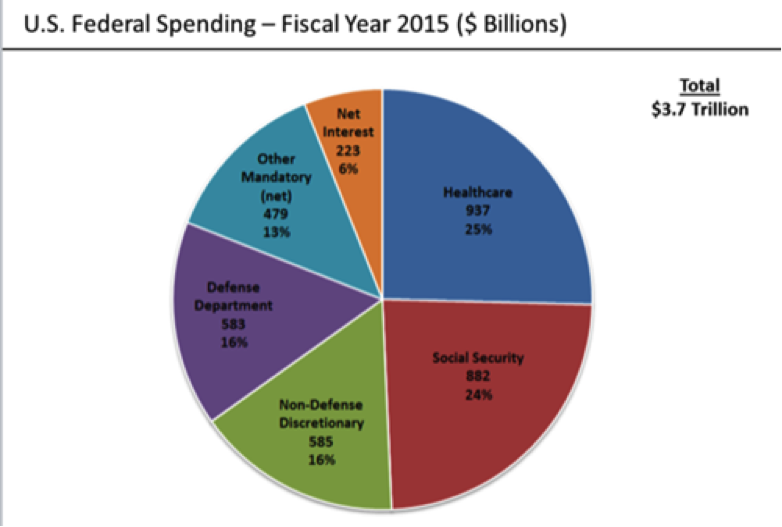

Finally, here’s a pie chart of federal spending in 2015:

Notice the two slices on the right: Social Security is 24% of the budget. And 25% goes for health care – which includes not only Medicare for retirees, but Medicaid (Medi-Cal here), the Veterans Administration, federal retiree health guarantees, etc.

Those two slices are guaranteed to increase, which means the rest of the slices will have to be cut. Even in that nutty new math they teach under Common Core in the California public schools, all of something = 100%, not 110% or 150%.

When the feds cut the gravy train, which inevitable, the California state budget, like most of us aging baby boomers, is going to find it’s going to have to go on a diet.

John Seiler wrote editorials for the Orange County Register from 1987 to 2016. He now writes freelance White Papers. His email: writejohnseiler@gmail.com