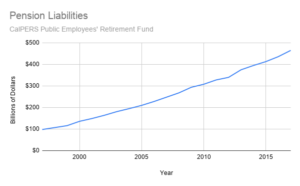

Pension liabilities reported by California’s largest pension fund (CalPERS) rose nearly 5x in just 20 years, from less than $100 billion in 1997 to nearly $500 billion by 2017. Those liabilities were not approved by voters. They simply showed up.

That steep growth happened because California employs an accounting method that allows it to initially suppress the value of pension promises to a fraction of their real value. But the deception is only temporary because the discount evaporates over time under a process known as “accretion.” Values that were initially suppressed spring back, and with vengeance. The bigger the suppression, the bigger the vengeance with which the liabilities spring back.

I call it “Potemkin Pension Accounting” because it’s rigged to make pension plans look better able to meet pension promises than they really are. That helps the beneficiaries of pension promises (government employees) to obtain richer pension packages without forcing elected officials to fund those promises until later. Were the true values of pension promises known when made, more funding would be required at that time or smaller pension promises would be made.

As the discount evaporates, so do government programs, which get crowded out by rising pension spending. State pension spending more than doubled this decade. School district pension spending more than tripled in five years. Much worse is on the way. This is why the practice of suppressing the true costs of pensions when they are created is so dangerous — and so jealously guarded by the beneficiaries of such a practice.

California could choose to report pension obligations honestly. But in 2006, when I told the State Senate that California’s pension funds were hiding liabilities that would later crush school and other budgets unless change was made, the only change they made was to remove me from the board of one of those funds. Their unwillingness to do the right thing at that time is why schools today are laying off teachers despite a ten year bull market, 30 percent income tax increase, and record tax and school revenues.

If you’re looking for a “tipping point,” that’s not likely to happen in the case of the state or its school districts. That’s because states can’t declare bankruptcy and California school districts are backed by the state. In such cases the consequences of rising pension costs are more like those faced by a frog in gradually warming water as public services are continually crowded out even though taxes are continually raised. That’s happening now and won’t stop until elected state officials enact reforms.

In contrast, there is a tipping point with local governments because they can declare bankruptcy. In those cases local government employees are at risk to forfeiture of their pensions and other post-employment benefits. Local employees should be particularly worried about dishonest pension accounting that hides the true size of the liabilities until it’s too late to fund them.

State and local governments provide the lion’s share of domestic services in our federalist system of government. Today, they are valuing unfunded pension liabilities (ie, the difference between liabilities and assets set aside to meet those liabilities) at just one quarter of the $4 trillion the same unfunded liabilities are valued by the Federal Reserve. That’s another way of saying they — including California — are hiding $3 trillion of debt. That money plus interest is being diverted from government budgets that residents are expecting to go to public education, safety, infrastructure and other services.

California is making new pension promises every day. State legislators should demand truthful accounting and contemporaneous funding of those promises