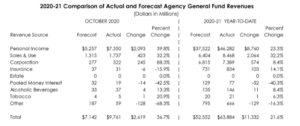

October General Fund tax revenues came in 37 percent above the 2020-21 Budget Act forecast, according to the latest Finance Bulletin from the California Department of Finance. Revenues through the first four months of the current fiscal year now exceed forecast revenues by $11 billion:

Revenue collections from March, when the state’s COVID-19 state of emergency was declared, are just 1.3 percent below the same period in 2019, which was a record year. That’s despite an 11 percent unemployment rate, which exceeds the national 6.9 percent unemployment rate by >50 percent.

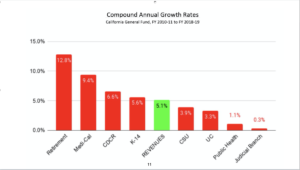

Don’t blame DOF for an inaccurate forecast. California’s tax revenues are heavily dependent on capital gains derived from inherently unpredictable stock markets that could — and one day will — go the other way. That’s why the legislature and governor must gain control over the pension and other retirement spending that is crushing state services even in good times:

COVID hasn’t altered that spending. Only the legislature and governor can do that.