How to blow up a spending limit

While attacking the spending limit for being too weak, “Anti-Tax Advocates” seem to have created their own confusion over spending limits. After weeks of denigrating Proposition 1A, even though it uses the venerable Gann Limit factors (population plus CPI) to limit revenue growth to control the revenues from the rainy day fund when needed, the advocates have suddenly scrambled to concoct an alternative to the so-called hard cap of population and CPI growth.

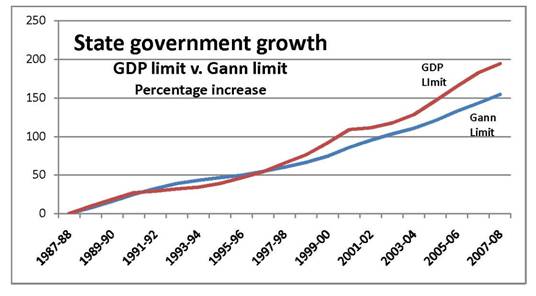

As stated in these pages last week, and reported again over the weekend, anti-tax advocates would prefer to limit spending not based on the Gann factors, but based on GDP growth. But, as the chart below shows, after 20 years spending under such a plan, the limit would have been $13 billion HIGHER than under the Gann Limit. No wonder the public employee unions have joined forces with them to oppose Proposition 1A.

State Government Growth: GDP Limit vs Gann Limit

State Government Growth: GDP Limit vs Gann Limit

College is for California

If you harbor any doubts that California must urgently prepare all students for college – and ensure they then graduate with a four-year degree – please spend a minute with this important recent study from the Public Policy Institute of California (PPIC).

Hans Johnson and Ria Sengupta, extending earlier work by PPIC, found that California’s economy will inexorably increase its demand for a highly educated workforce, but “the state is unlikely to meet this demand unless decisionmakers implement policies that effect substantial changes in college attendance and college graduation among the state’s young adults.”

Axing the high school exit exam?

The enemies of accountability for schools and high performance for students were out in force on the occasion of a bizarre study from Stanford and UC Davis researchers.

Most disconcerting was a victory dance by a business organization claiming the high school exit exam a “failure.”

First, it’s more than a little unseemly to flack a policy outcome (in this case, mandated vocational education programs) by incorrectly claiming that the exit exam is a failure. Heck, the study’s authors didn’t even claim that.

Dreadful employment picture

You may have heard that the California unemployment rate for March was reported to be 11.2 percent

California may not have seen such a high monthly unemployment rate since the 1950s or even the 1940s. But recall that during the 1981 recession, which was relatively short, the unemployment rate stayed at or above 10 percent for 12 consecutive months.

But the picture gets even worse when you compare the job losses for this recession with the three previous recessions over the past 30 years. The chart below shows that California job losses (as a percentage of total nonfarm employment at the peak of the cycle) in this recession have been deeper and accelerated faster than during any of the previous recessions.

?

California Housing: Ready to Recover?

More good news and bad news for the California housing economy.

Home prices continue their unabated decline, but existing home sales are on a roll – especially in inland California. New housing starts are still anemic, but government programs are poised to subsidize that end of the market.

First the bad news:

California home prices continued their freefall into 2009. The Standard and Poor’s monthly index of metro home prices showed California registering another record year-over-year drop. The composite average for San Francisco, Los Angeles and San Diego prices dropped in January by 27 percent from the previous year, the same as December’s year-over-year drop, but short of the recorded by the state, and exceeded only by the Sunbelt cities of Phoenix and Las Vegas.

Prop 1A is the real deal

Opponents of Proposition 1A need to stop watching Saturday morning cartoons long enough to read a copy of the ballot measure. The budget reform on the May special election ballot is not Proposition 58 redux; it is in fact the fix to Prop 58 that the Legislature refused to enact in 2004 – but which Republicans insisted as their price for agreeing to this year’s budget solution.

Proposition 58 did not place a limit on spending. Proposition 1A caps revenue growth to the average growth of revenues over the past 10 years – which will provide an effective damper on state spending increases. Don’t take my word for it, ask the California Budget Project, a liberal think tank, which recently reported that “the revenue forecast established by Proposition 1A, which limits spending from the state’s existing tax base, would be significantly below the Governor’s ‘baseline’ spending forecast.” Any revenues that exceed that trend are automatically deposited into the rainy-day fund.

California’s lost leadership in foreign trade is a symptom of larger economic problems

A consequence of California’s changing industry mix – the decades-long shift from manufacturing and production to service jobs – is in our international trade profile. Traded goods bring the most value to an economy – and usually create the best jobs. According to the latest figures from the International Trade Administration , California used to be the leading state in foreign goods trade – but no longer.

Until the collapse of the technology bubble in 2001, California was the nation’s leading merchandise exporter. Since then, Texas has claimed bragging rights – and not just in the petrochemical industries. California still leads the country in computer exports, but Texas is now the leading exporter of machinery, electrical equipment, plastics and fabricated metals. And it is gaining fast in high tech exports.

Tax Commission: Keep It Simple

When the Governor and Assembly Speaker created the Commission on the 21st Century Economy, aka, “Tax Commission,” their main concern was, in the Governor’s words, “basically just looking for one thing, and that is to create stability.” Indeed, the Governor specifically charged the Commission to “Stabilize state revenues and reduce volatility.”

To assist the Commission in its efforts, the California Foundation for Commerce and Education prepared a brief policy paper examining the state’s tax system to determine if it is broken, and what we are trying to fix. Our conclusion was simple: if you want to fix budget volatility, look no further than Proposition 1A on this May’s statewide special election ballot. But if you want to fix the state’s tax system, you’d better get agreement on defining the problem.

Return of the Chopping Block

Earlier this week, I made the case that Proposition 1A would achieve what no predecessor spending limit had: a sustainable, enforceable spending limit and mandatory rainy-day reserve that actually work. But wait … there’s more.

Approval of Proposition 1A would also trigger new powers for the Governor to reduce state spending without legislative sanction. This would be the first time a Governor could wield this common sense management prerogative since Governor Deukmejian was forced into surrendering similar powers in 1983.

The authority is limited, but significant. If the director of the Department of Finance determines that revenues will dip "substantially" below – or spending will rise substantially above – budget estimates, then he or she may:

After 30 Years, A Budget Reform That Will Work

The most important difference between Proposition 1A – the budget reform measure on May’s special election ballot – and the numerous attempts to control spending or enforce balanced budgets that have preceded it: Proposition 1A might actually work.

California ballots and, indeed, the Constitution itself, are strewn with well-intentioned efforts to impose discipline on state elected officials. But each of these measures has failed because it either frustrated public demands to provide more resources for priority needs, such as transportation or education, or was never designed to work as advertised in the first place.

This is no small thing. It makes no sense to propose or adopt a tough measure to impose fiscal discipline if it won’t be adopted, doesn’t work, or cannot pass the test of time. But that’s been the track record over the past thirty years: