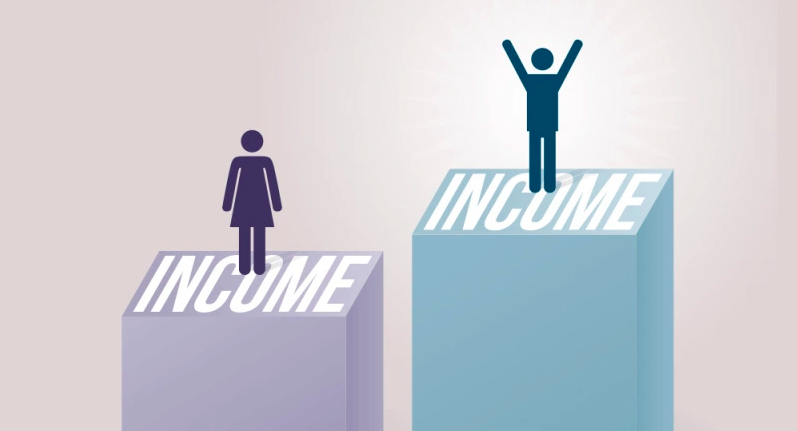

2018 Brings Salary History Prohibition: Employers Beware

Starting January 1, 2018, all California employers will be prohibited from asking about a job applicant’s prior salary history. This prohibition applies to both public and private employers, regardless of size. Governor Jerry Brown signed AB 168 (Eggman) on October 12 as Chapter 688. This bill adds Section 432.3 to the Labor Code. The bill has a number […]

California’s Gas Tax on Its Way Up

In the State of California, there are a variety of sources of funding for transportation purposes, including funding for the state highway system and the local streets and roads system. These funding sources include fuel excise taxes, commercial vehicle weight fees, local transactions and use taxes, and federal funds. Because of legislation earlier this year, […]

Final Bill Tally

Bills Signed into Law by the Governor: 859 Bills Vetoed by the Governor: 118 Bills Allowed to Become Law without the Governor’s Signature: 0 Total Bills Acted Upon: 977 Signing Percentage: 88% Veto Percentage: 12% Of the 859 bills that the Governor signed this year, 567 were Assembly Bills and 292 were Senate Bills. […]

Bills Facing the Business Community When the Legislature Reconvenes

Even though the 2017 Legislative Session recently concluded, the California business community needs to be aware of “2-year bills” that will be considered when the Legislature reconvenes on January 3, 2018. There are nearly 1,000 of these two-year bills that are technically alive, at least until the constitutional deadline of January 31, 2017 to clear their […]

Will PAGA Finally Be Reformed at the Ballot Box?

Earlier this month, three separate initiatives were submitted to the California Attorney General for title and summary to reform California’s Private Attorneys General Act (PAGA) statute because this law continues to be of significant concern to California employers. Enacted over a dozen years ago, PAGA allows employees to sue their employers in a “representative action” […]

The Legislature Should Not Adopt APA Exemptions

A fundamental purpose of both the federal and California Administrative Procedure Acts (APA) is to allow public participation in the federal and state rulemaking processes. This is where the executive branch engages in quasi-legislative activities by adopting rules and regulations to implement statutes passed by the legislative branch of government. Key to allowing public participation […]

Why the Governor Should Veto SB 63

The business community supports and promotes family-friendly policies so long as these measures do not impose an undue financial or compliance burden upon businesses operating in this state. Unfortunately, SB 63 (Jackson) does not fit this mold. To make matters worse, last year Governor Brown vetoed a similar bill by the same author that would […]

Why the Governor Should Veto AB 1209

While the business community is strongly in favor of gender pay equity and many of us worked diligently two years ago to enact SB 358 (Jackson) to make California’s Equal Pay Act the “toughest in the nation,” Governor Brown should veto AB 1209 (Gonzalez Fletcher), which is intended to publicly shame companies based upon a […]

Bills, Bills, Bills…The Tally

817 bills were introduced in the Senate in 2017. Of those, 514 bills were passed by the Senate, while only 3 were refused passage on the Senate Floor. That leaves 303 bills as 2-year measures which may be considered in January 2018. So, 63% of introduced bills passed out of the Senate, while .4% of […]

Three Weeks and 966 Bills to Go

Based upon a rough count, there are 436 pending measures on the Assembly and Senate Floors (292 on Senate Floor and 144 on Assembly Floor) as of this Monday’s floor session (August 28). In addition, there are about 511 pending measures in the Senate and Assembly Appropriations Committees (347 in Senate and 164 in Assembly). […]